News

August 17, 2023 2023-08-17 13:20News

News

News

LUBM Smart Talks: Harnessing the Potential of Electromobility and Sustainability with Kivanc Karayol

LUBM Smart Talks was created with a foundational idea in mind. It aimed to provide students access not only to premium education but also to insights from industry experts. …

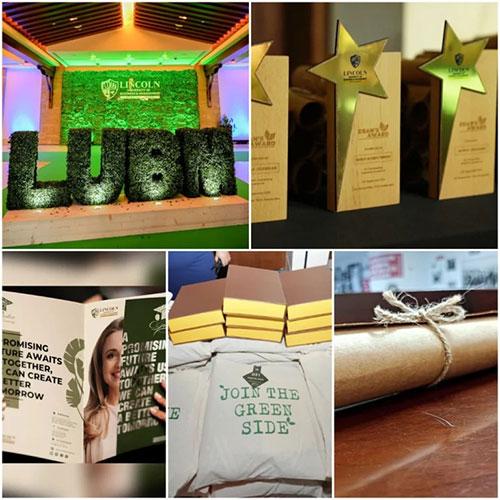

SUSTAINABILITY: LIVING GREEN WITH LUBM

Sustainability Sustainability growth is a way of life, not just a goal. The pillars of sustainability indicate programs, initiatives, and actions aimed at the preservation of a particular resource. Everyone …